¡Good day! We’ll walk you through the process of raising your CIBC credit card limit in a few easy steps. To spend more freely, you’ll probably need to increase your CIBC credit card limit. At the end of this piece, we’ll guide you through the process and provide you some details regarding this limit.

Increase CIBC Credit Card Limits Procedure

You must first carry out the following actions in order to apply for a credit boost on your CIBC card:

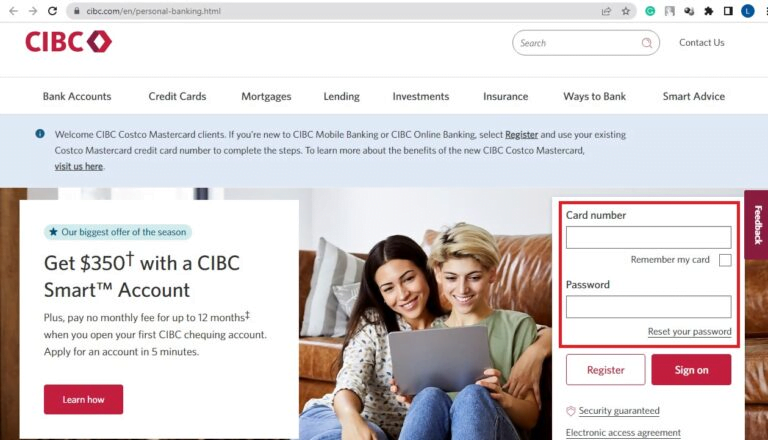

- Go either to the CIBC Online Banking website or the Mobile Banking app.

- Log in to your account to start the process.

- From the drop-down option, select “Customer Services”.

- Choose “Apply for a credit limit increase” and adhere to the prompts on the screen.

- All there is to it is that! A few days will pass before you receive confirmation. You will instantly apply the necessary amount once you get approval.

You may always get in touch with a CIBC employee if you experience any difficulties seeking the expansion. They give a customer support hotline for anyone who would rather make their request over the phone. To seek an increase in your credit limit, call 1-800-465-4653, and a representative will assist you through the steps.

Eligibility for a CIBC Credit Card Limit Increase

The bank decides your credit limit when you first get your credit card mostly based on your credit history. In other words, your CIBC credit card limit will be based in part on your income, debts that you have and have not paid, and credit score.

The truth is that the bank favours clients who are reliable with their credit card payments. As a consequence, you will probably receive a high limit if you make your payments on schedule and in full. Your credit limit will be low if you have unpaid debts on your record.

However, you must first fulfill the following criteria in order to apply for a raise:

- The primary cardholder must be the applicant.

- You’ve had your credit card account open for at least six months.

- You haven’t agreed to a credit limit increase offer in the last six months.

- You had a stellar track record of paying your bills on time (making at least the required minimum each month).

- Of course, your credit card account must be in good standing.

Is it risky to request an increase in the credit limit on my CIBC credit card?

Always consider your intended usage of the new limitation before making a decision. In an emergency, such as when paying for medical expenses, it is helpful. You’ll feel more at ease in this case knowing that you have enough credit available to cover unforeseen costs.

Having a greater limit, meanwhile, suggests that you could occasionally overspend. Keep in mind that you will be required to pay interest on your spending if you exceed your limit. Your credit score might suffer as a result, which would make it more challenging to be accepted for other services.

We strongly advise that you only utilize a portion of the available credit on your credit card. However, you are always free to ask to have your CIBC credit card limit decreased. Although you won’t have as much money to spend, you’ll have more chances to pay your bills back.