Internet banking is a service that ICICI Bank offers to its credit card holders in order to make it simpler for them to manage their credit card accounts. A variety of online services are accessible through credit card internet banking. These comprise facts on checking accounts such as the credit/cash limit on the card, transaction information, payments that are overdue, monthly bills, etc.

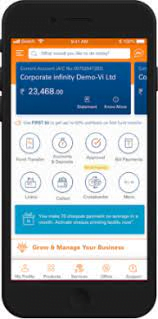

ICICI Net Banking

In addition, clients who have registered for internet banking are able to submit a variety of credit card-related requests. These demands could include getting a credit card loan, raising the credit card limit, using reward points, etc. For its consumers, ICICI credit card online banking offers significant time and energy savings as well as contactless and secure banking.

How to Sign Up for Internet Banking with an ICICI Bank Credit Card

The decision to use ICICI credit card online banking is simple and involves just two steps:

Customers of ICICI Bank Who Have Net Banking Currently:

- Credit cards may be easily linked to an account by account users who already use ICICI Net Banking.

- Visit the website for ICICI Internet Banking. https://infinity.icicibank.com/corp/Login.jsp

- Enter your user name and password to access your account.

- Under “Customer Service,” choose “Service Requests.”

- ‘Link my Credit Card Account to my User ID’ is the option you want to select under ‘Credit Card’ when you scroll down the page.

- On the next page, fill in the details. such as the payment card number, expiration date, cellphone number, and email address. It will automatically fill up the ICICI savings account. If a customer has multiple accounts, they may select which one to link.

- Click “Submit” after reading the terms and conditions.

- There will be a confirmation page. On the registered cellphone number, an OTP will be issued.

- Please enter the OTP to confirm.

- The service request number and a confirmation message will be shown on the screen.

- To follow the status of the application, note down the number.

- In one working day, the processing of the request to link the credit card with online banking will begin.

- A message is sent once the credit card is linked and is made active in the online account.

Existing ICICI Bank clients without a net banking account:

Account holders with ICICI Bank must first sign up for online banking if they do not already have one. You may accomplish this through phone banking, going to the bank branch in person, or even online.

New Users of ICICI Bank Credit Cards

Customers must create a User ID and Password in order to use ICICI Credit Card Internet Banking. The actions listed below must be followed in order to create the identical one:

How to Create an ICICI Credit Card Net Banking User ID

- Contact ICICI Bank Customer Care.

Choose ‘Option 2’ if you want to use a credit card. - Enter the 4-digit PIN and the credit card’s 16-digit number.

- The credit card balance may be obtained using the IVRS (Interactive Voice Response Service). Select “Self-Banking” under “Option 1.”

- Click “Option 1” to obtain a User ID.

- If the client wants to alter their User ID, they should choose ‘Option 3’ to reset their User ID.

ICICI Net Banking Password Generation Procedure

To create a password, follow these instructions:

- Log in to ICICI Internet Banking. https://infinity.icicibank.com/corp/Login.jsp

- Click on “Get Password” under the “May I Help You” area.

- Choose the “Online Password Generator” page.

- Enter a User ID and press the Go button.

- Enter your registered mobile number and click “Go.”

- Following that, a special number is delivered to the registered phone. Kindly type the same number.

- A new password will be generated when the data have been verified.

- To log into net banking, use your User ID and password.

Making requests with an ICICI credit card’s online banking account

- Requests pertaining to statements may be made by visiting “My Account>Credit Card>Service Request.” You can submit requests for ICICI credit card statements. This includes the physical statement’s activation or deactivation, requests to receive credit card statements by email or postal mail, etc.

- This covers requests to activate or deactivate the physical statement, request to email credit card statements, request to mail credit card statements, etc.

- Account information update requests may be made by going to “My Accounts>Credit Cards>Alert subscription>Submit.” You may update your personal and account information using ICICI Internet Banking. Included in this are the address, PIN generator, credit card cancellation, etc.

- Redeem points earned through rewards programs by entering into your account to view your points balance. Go to ‘My Accounts>Credit Cards>Reward Points>Redeem Online’ to redeem the points. After selecting a choice from the list, click “Submit” to complete the redemption.

- Request concerning banning credit cards: block the card through online banking if it has been lost or stolen. Click “My Accounts>Credit Cards” and then click “Block your Credit card – Instant deactivation.” Select a credit card number, then lock that number.

- When a credit card is reissued and either not delivered or needs to be returned, a new credit card is sent out. Request that it be sent using internet banking’s “My Accounts>Credit Cards> Service request > Re-dispatch request for an undelivered card.”

- Payments made with a credit card that are over Rs. 3000 can be made in EMIs within 30 days of the purchase date. To convert a credit card to an EMI, select “My Accounts>Credit Cards.”